Why Are Taxes So Hard To Do?

Cardinal Team

Why Are Taxes So Hard?

As tax season winds down and you’re deep in your last-minute filing, you’ve probably caught yourself thinking, “why are taxes so stinkin’ hard?!”

No doubt, I’ve sat in front of my computer on late nights trying to figure this all out. More than once, I’ve yelled at the umpteen boxes I have to fill in and questions I have to answer while I’m on TurboTax. Sparing the details, my frustrations boil down to, “why can’t these jokers just tell me a nice flat percentage that I owe?!”

So, I’d like to take this opportunity to clear up a little bit of the confusion of taxes.

Important Tax Vocabulary & Definitions

There are all sorts of details and crazy vocabulary terms. These four are some of the most common in tax discussions, and might not be well understood:

- Standard deduction

- Personal exemptions

- Marginal rates

- Effective rates

Standard Deduction: this reduces the amount of income subject to taxation by an amount determined by the government. At the federal level, the standard deduction amount is $12,400 for single filers, $24,800 for married filers, and $18,650 for heads of household. In West Virginia, there is no standard deduction that applies when filing state taxes.

Personal Exemption: similar to the standard deduction, this also reduces the amount of income subject to taxation. However, this doesn’t have a pre-set amount applied by the federal government to personal income. In West Virginia, these exemptions do apply at the levels of $2,000 for single filers, $4,000 for couples, and $2,000 for dependents.

Marginal Rates: these are the tax rates applied to each additional dollar of income earned. Here’s where the math starts to get more complicated. In West Virginia, these rates break down to:

- 3.00% on every dollar of taxable income earned

- 4.00% on every dollar of taxable income above $10,000 earned

- 4.50% on every dollar of taxable income above $25,000 earned

- 6.00% on every dollar of taxable income above $40,000 earned

- 6.50% on every dollar of taxable income above $60,000 earned

West Virginia Income Tax Examples

$27,000 gross income ($25,000 taxable income) – Single Earner

(3% x $10,000) + (4% x $15,000)

$300 + $600 = $900 owed in state income taxes

$52,000 gross income ($50,000 taxable income) – Single Earner

(3% x $10,000) + (4% x $15,000) + (4.5% x $15,000) + (6% x $10,000)

$300 + $600 + $675 + $600 = $2,175 owed in state income taxes

$102,000 gross income ($100,000 taxable income) – Single Earner

(3% x $10,000) + (4% x $15,000) + (4.5% x $15,000) + (6% x $20,000) +

(6.5% x $40,000)

$300 + $600 + $675 + $1,200 + $2,600 = $5,375 owed in state income taxes

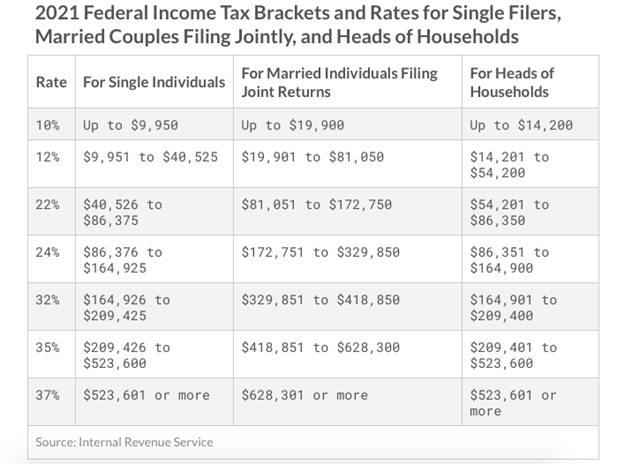

The math gets even more complicated at the federal level. I’ll spare the step-by-step breakdowns. But this chart below is for any of you math junkies out there who want to play with those numbers for yourselves.

Effective Rates: this is the average rate of taxes paid across all income earned. In math terms, it’s the total tax paid divided by taxable income.

Let’s refer back to the three West Virginia examples from earlier, and see what their effective rates are.

$27,000 single earner: 3.33% effective WV income tax rate

$52,000 single earner: 4.18% effective WV income tax rate

$102,000 single earner: 5.27% effective WV income tax rate

If you’ve made it this far, congratulations, and thank you! I hope you’ve gained a slightly better understanding of some of the terms thrown around during tax season.

…and if not, know that you’re in plentiful company.

Jessi Troyan, PhD. is the Development Director for the Cardinal Institute for West Virginia Policy.

Learn more about state tax policy and how it impacts you by reading our commentary articles.

Our favorite resource to share for information on tax policy is the Tax Foundation.