What is the Marriage Penalty?

West Virginia Tax Plan Includes Elimination of the Marriage Penalty

The new income tax cut plan unveiled and then quickly passed by the West Virginia State Senate involves a number of changes to the state’s tax code. One change that was highly touted in the senate press conference was addressing what’s known as the “marriage penalty” in our tax code.

Such an announcement invites us to pause for a moment and align our understandings. With that in mind, let’s begin with what a marriage penalty is.

What is the Marriage Penalty?

Based on standard tax policy understanding, and information from our friends at the Tax Foundation, a marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. This typically occurs when spouses have similar incomes. Whether the spouses are both high or low earning is somewhat irrelevant, so long as the incomes are similar.

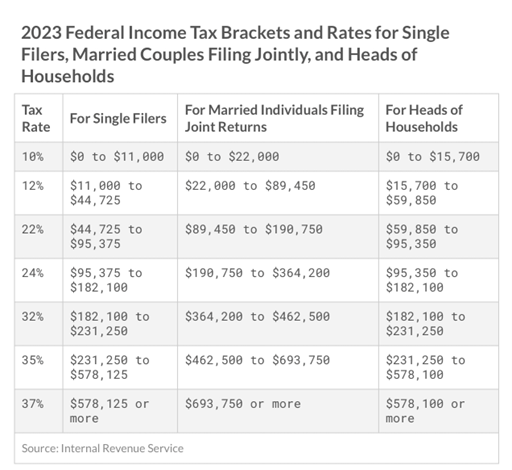

How do policymakers avoid creating a marriage penalty? A picture simplifies.

In this example from the federal income tax brackets, we can see that the brackets double in size between ‘Single Filers’ and ‘Married Individuals Filing Joint Returns.’ The notable exception here is the top bracket and the highest earners. The point remains: for the vast majority of taxpayers, legally joining in marriage does not harm them financially when it comes time to pay taxes.

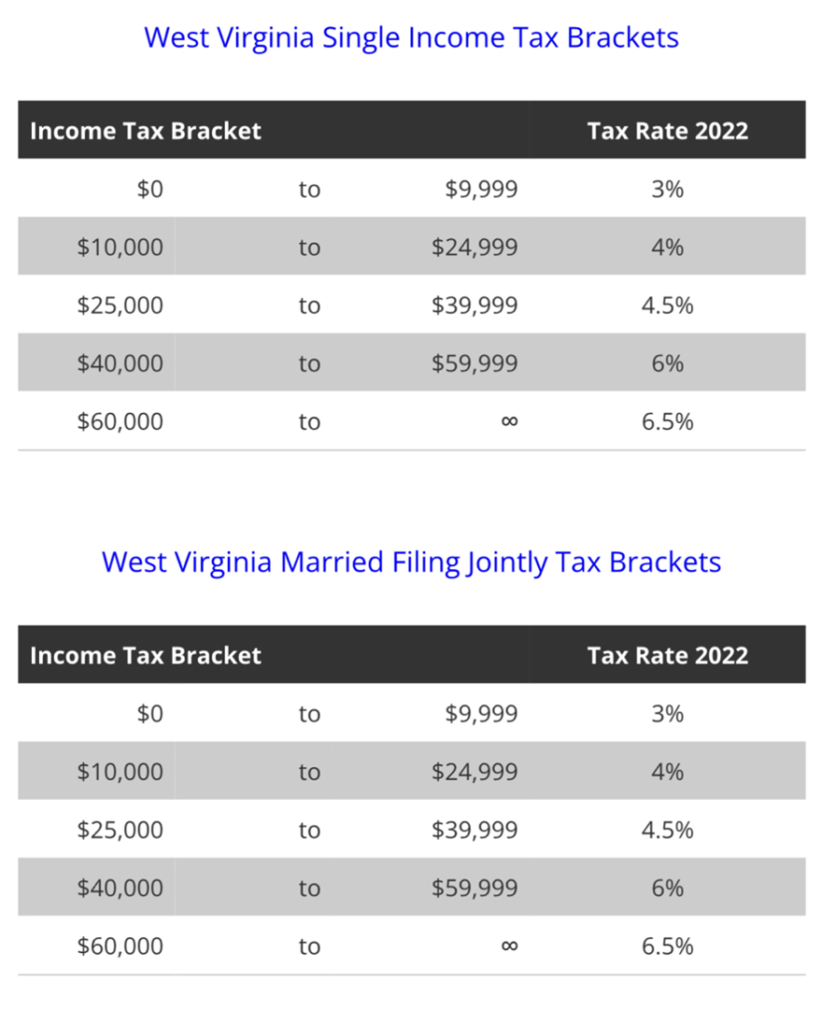

Looking strictly at the brackets, the marriage penalty is alive and well in West Virginia.

Remember at the federal level where the bracket doubled when a couple married and filed jointly? Do you see that here? No. The bracket widths stay the same from a ‘Single Filer’ to ‘Married Filing Jointly.’

Further Explanations

We know from past posts, I’m a numbers gal, so let’s go do the math. According to 2021 census data, per capita income in West Virginia is $28,761. That West Virginian would be paying $1,069.25 in personal income taxes. Now let’s assume Mr. West Virginian finds a Ms. West Virginian to marry that also earns the per capita average of $28,761 and pays $1069.25 in income taxes.

Together, they’re making $57,522 as a married couple. Together, they’re paying $2,626.32 in personal income taxes as a married couple.

Had they cohabitated and continued to do their taxes as single filers, they’d be paying only $2,138.50 in income taxes. By marrying, the state income tax regime rewards them with an approximately $500 extra in tax liability.

A disclaimer: according to our friends at the Tax Foundation, West Virginia offsets this penalty by allowing married folks to file separately on the same return in order to maintain credits and exemptions. Nonetheless, the core of the income tax code is constructed in such a way that any couple making above $10,000 together gets penalized with a higher tax liability than had they remained single.

Jessi Troyan is the Director of Policy & Research for the Cardinal Institute for West Virginia Policy.