REPLACING THE STATE PERSONAL INCOME TAX WITH HIGHER SODA TAXES WON’T WORK

Eliminating the state income tax has been a popular topic of discussion lately in West Virginia. Even Forbes has picked up the story! The Governor mentioned it in his State of the State address. He even declared that eliminating the personal income tax (PIT) is his biggest priority this year. Additionally, one of his many suggestions for offsetting the costs associated with eliminating the PIT was to significantly increase West Virginia soda taxes.

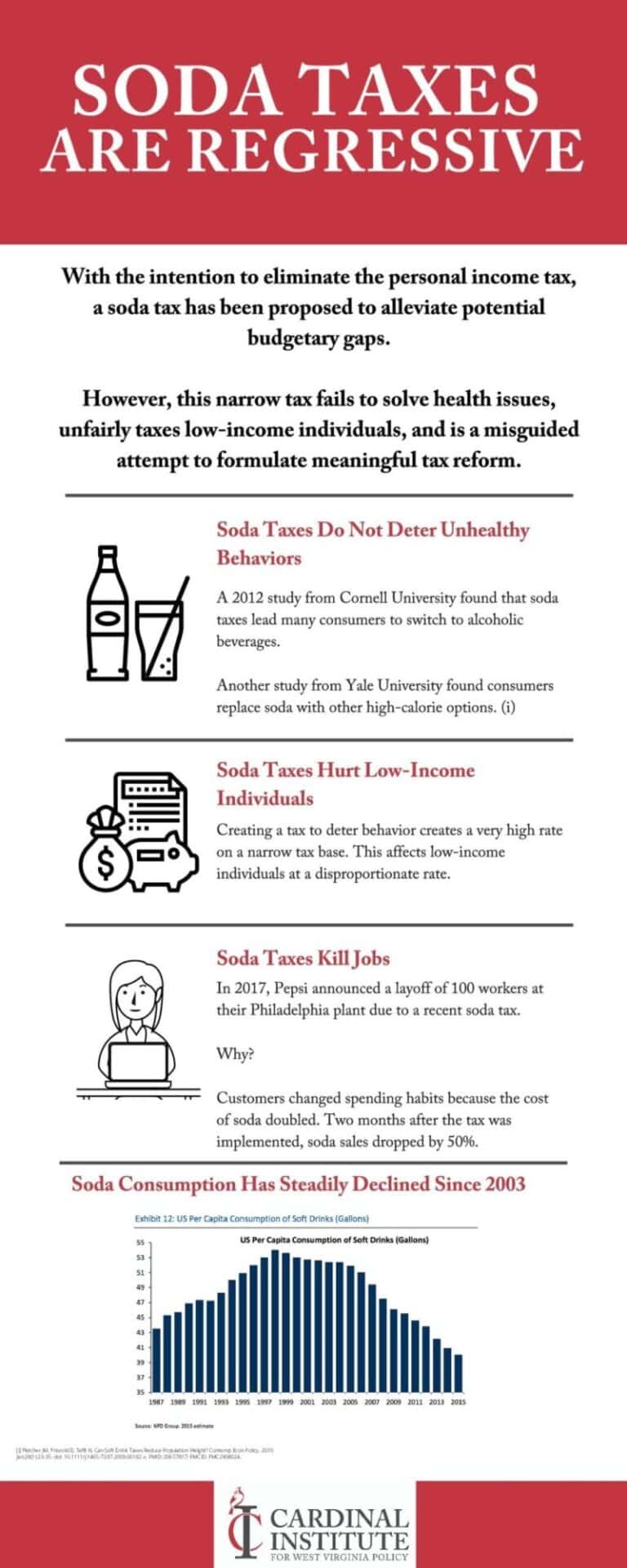

This new infographic explains why relying on soda taxes in place of a state income tax is a bad idea. Our policy team breaks down complicated tax policy into simple bite-sized chunks that everyone can understand!

ELIMINATING WEST VIRGINIA’S PIT IS STILL A GOOD IDEA

Although we think soda taxes are a bad replacement we still want to eliminate PIT. More money in the pockets of every day West Virginians is a good thing. However, there are better ways to achieve that goal. And good public policy takes time and planning.

You can learn more about sound tax policy on our YouTube channel! Watch our interview with Jared Walczak from the Tax Foundation!

READ MORE FROM CARDINAL

*You can learn more about income taxes in West Virginia on the Cardinal’s Nest blog.

*If you want to learn more about plans to eliminate the West Virginia personal income tax (PIT), you can view our other publications here.

*You can also keep up with the Cardinal Institute on Twitter @CardinalWV.

*Subscribe to our Wild & Wonderful Wednesday newsletter by filling out this contact form and putting NEWSLETTER in the subject line.