West Virginia Should Consider Refundable Education Tax Credits in 2022

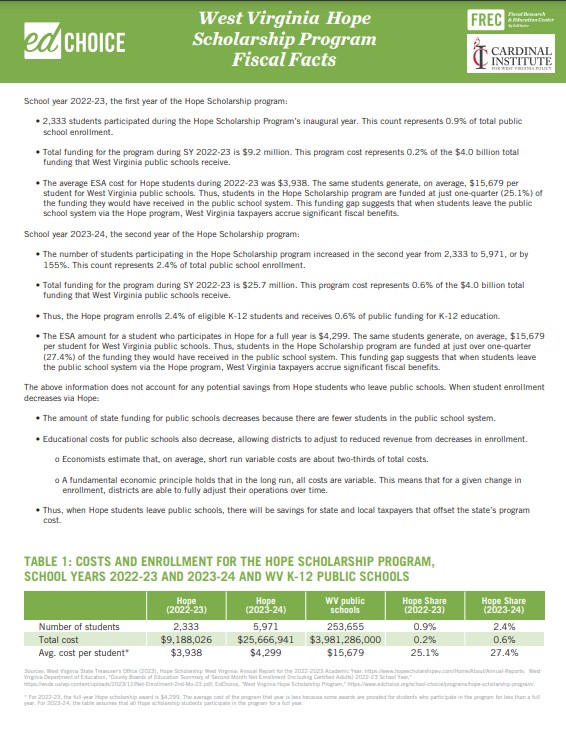

The future of education is strong in West Virginia. The Hope Scholarship is heading towards full implementation in July, and five charter schools will be operational for the 2022-2023 school year. With these two victories achieved, what’s next for education in West Virginia? One option that lawmakers could consider is the implementation of a Refundable K-12 Education Tax Credit

Why Should West Virginia Consider a Refundable K-12 Tax Credit?

West Virginia has become a leader in promoting education freedom. The passage of the Hope Scholarship ushered in a near-universal Education Savings Account that will open up new opportunities to West Virginia students and families. The passage of a Refundable Education Tax Credit will further provide opportunities to families who are currently not eligible for Hope or do not wish to participate in the program. A Refundable Education Tax Credit also has greater value to families with low and modest incomes than traditional tax credit programs do.

Overview of Tax Credits

I’ll start by defining a few different tax terms. A tax credit is different from a tax deduction. According to the IRS, tax credits provide a dollar-for-dollar reduction of your income tax liability while tax deductions lower your taxable income equal to the percentage of your marginal tax bracket. In other words, “if you are in the 10% tax bracket, a $1,000 deduction saves you $100 in tax (0.10 x $1,000 = $100).” While a nonrefundable tax credit reduces your liability, a refundable tax credit is paid directly to you.

There are very few education tax credits in the United States. The Federal Government has two tax credits available for higher education expenses. The only federal program available for pre-college education is a Coverdell Education Savings Account. At the state level, there are eighteen states that offer corporate tax credits that contribute to voucher programs. However, since West Virginia does not have a voucher program, this post will focus exclusively on K-12 Education Tax Credits. According to EdChoice, six states offer individual tax credits to families of K-12 Students, and four offer education deductions.

States That Have Tax Credit Programs

According to EdChoice, there are nine states that use tax credits or deductions. Of those nine, only two offer refundable tax credits. Only six states offer tax credits, so the research is scarce. However, using EdChoices’ resources, we can determine the impact of these programs – taking into account the variation across different states’ programs. The six states that offer tax credits are:

- Alabama – Refundable

- Illinois – Nonrefundable

- Iowa – Nonrefundable

- Minnesota – which offers both deductions and nonrefundable credits.

- Ohio – which offers separate nonrefundable homeschooling and non-chartered private school

- South Carolina – Refundable

Each of these credits has benefited those eligible to receive them. For example, in South Carolina, as of 2021, $2,257,251.43 in education tax credits have been approved for students and report on the 2017-2018 school year found the scholarship helped students to be level to their peers (the most recent study was inconclusive due to COVID-19). Alabama’s tax credit, which is reserved for students attending a failing school, as designated in Ala. Code § 16-6C-2, has been valued at 80% of the total cost to attend a public K-12 school. Ohio offers a tax credit to 100% of Ohio Homeschoolers.

Even considering the successes of each tax credit there are setbacks which limit their impact. These issues include arbitrary definitions, the small value of the tax credits, and income requirements which turn implementation into a bureaucratic nightmare.

Let’s Continue to Expand Education Choice in West Virginia

West Virginia has been a leader in education choice reform with the passage of the Hope Scholarship and can do the same with refundable education tax credits. By learning from what other states have done, West Virginia can continue to be a leader in education reform. Passing a refundable tax credit that is available to families who are not participating in Hope is one way to do this. This would help them attain their education needs.

Andrew Bambrick is the Education Outreach Coordinator for the Cardinal Institute for West Virginia Policy.